Risk Management and Corporate Governance in 21st Century Digital Economy Nova Science Publishers

Gregory M Carroll has updated his 2013 book Mastering 21st Century Enterprise Risk Management. This comprehensive edition includes new standards on Resilience and Compliance and the change in approach from rigid procedures to a focus on the outcome. "Just as the Wild West of the 1890s had disappeared without trace by the Roaring 1920s, so too the business world of the 1990s will disappear in.

Mastering 21st Century Enterprise Risk Management Executive's Guide

Nonfinancial risk is found to be deeply embedded in corporate operations. As the 21st-century business environment became more volatile and disruptive, however, companies began to question standard risk-management approaches. The thought leaders among them are now calling for new approaches that go beyond risk management, toward corporate.

Building a risk management framework for a 21st century business News Strategic Risk Europe

Buy the eBook Mastering 21st Century Enterprise Risk Management - 2nd Edition, The Future of ERM - Book 1 - Executive's Guide by Gregory M. Carroll online from Australia's leading online eBook store.. "Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM from an overhead to a value-adding driver of.

Enterprise Risk Management

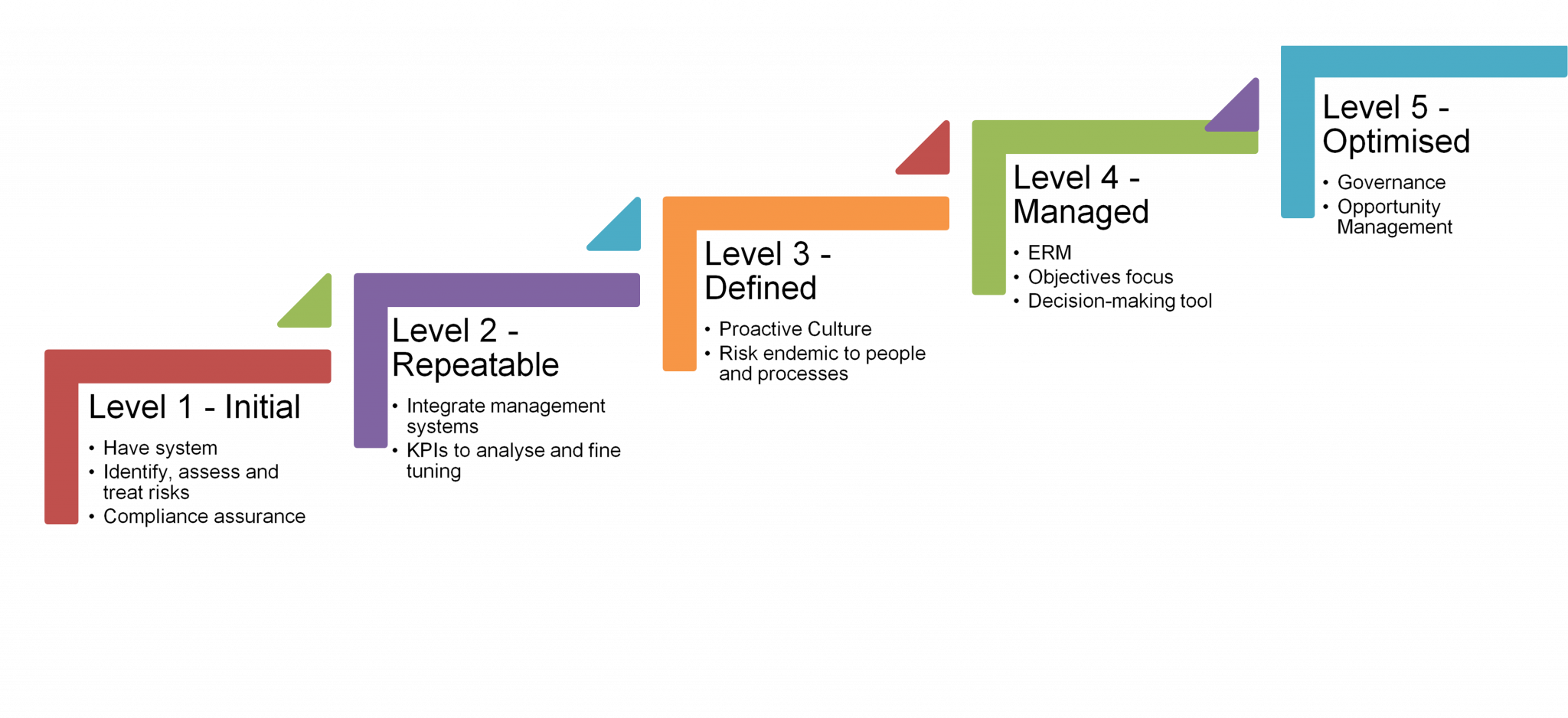

"Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM from an overhead to a value-adding driver of growth. It combines the best of ISO 31000 and COSO ERM to deliver bottom-line returns.

Mastering 21st Century Enterprise Risk Management 2nd Edition The Future of ERM Book 1

"Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM. This book provides executives the foundations required to implement AI-based Risk Management. Artificial intelligence based risk management is the Future of ERM. As such, Good Governance, Ethics, Strategic Management, and Risk based Auditing, are all necessary perquisites for tackling the.

Risk Intelligence AI in Risk Management The Future of ERM

"Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM from an overhead to a value-adding driver of growth. It combines the best of ISO 31000 and COSO ERM to deliver bottom-line returns. By linking risk to strategy using Scenario Analysis, Bayesian modeling, and aggregating their effect, it allows organizations to fulfil the primary directive of ISO.

LKNA14 21st Century Risk Management Dennis Stevens YouTube

Read "Mastering 21st Century Enterprise Risk Management - 2nd Edition The Future of ERM - Book 1 - Executive's Guide" by Gregory M. Carroll available from Rakuten Kobo. "Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM from an overhead to a v.

The Three Steps Of Risk Management

Read Mastering 21st Century Enterprise Risk Management by Gregory M. Carroll for free on hoopla. Risk management has traditionally focused on the downside-the "what if"-of risk: "What if I get audi | hoopladigital.com

Frameworks for Risk Management

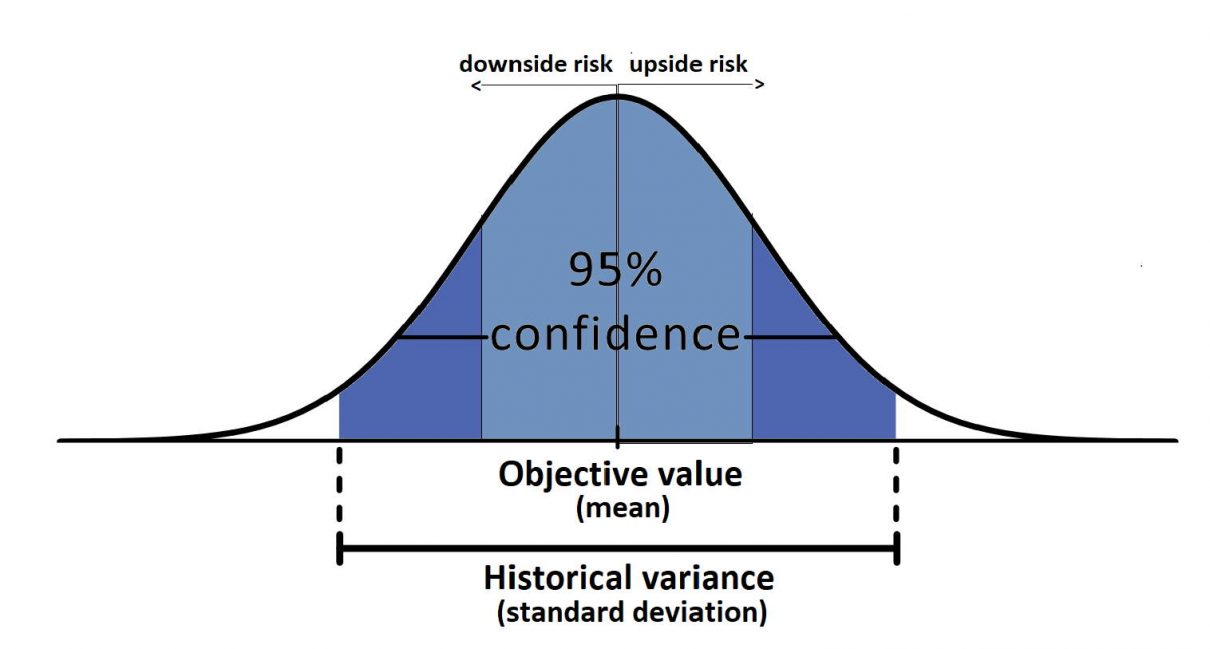

Risk management has traditionally focused on the downside—the 'what if'—of risk: 'What if I get audited; will my documentation be in order?. Mastering 21st Century Enterprise Risk Management: Firing Dated Practices The Best Practice of ERM Implementation Secrets 92.

Risk Intelligence AI in Risk Management The Future of ERM

Author of "Mastering 21st century Enterprise Risk Management", Greg is a strong advocate for applying Bayesian techniques and disruptive technologies to Risk Management. As founder and Director of Fast Track (Aust), Greg has implemented both Machine Learning and Risk Management solutions for multinationals like Motorola and Serco.

Mastering 21st Century Enterprise Risk Management Executive's Guide

Mastering 21st Century Enterprise Risk Management - 2nd Edition: Firing Failed Practices | The Best Practice of ERM | Implementation Secrets (Future of ERM) : CARROLL, GREGORY M.: Amazon.com.au: Books

Mastering 21st Century Enterprise Risk Management Executive's Guide

Author of "Mastering 21st century Enterprise Risk Management", Greg is a strong advocate for applying Bayesian techniques to Risk Management. Founder and Director of Fast Track (Aust), Greg has extensive experience in implementing both ML and Risk Management for multinationals like Motorola, Fosters and Serco. More.

Risk Intelligence AI in Risk Management Future of ERM

"Mastering 21st century Enterprise Risk Management" is an Executive's Guide for transforming ERM from an overhead to a value-adding driver of growth. It combines the best of ISO 31000 and COSO ERM to deliver bottom-line returns. By linking risk to strategy using Scenario Analysis, Bayesian.

Enterprise Risk Management Stock Illustration Image 44432088

Mastering 21st Century Enterprise Risk Management - 2nd Edition: Firing Failed Practices | The Best Practice of ERM | Implementation Secrets (Future of ERM) [CARROLL, GREGORY M.] on Amazon.com. *FREE* shipping on qualifying offers. Mastering 21st Century Enterprise Risk Management - 2nd Edition: Firing Failed Practices | The Best Practice of ERM | Implementation Secrets (Future of ERM)

ERM Book Advance Copy Reviewers Wanted Future of ERM

Gregory M. Carroll is an AI based Risk Management evangelist with 30 years exp in ERM, IT, and Artificial Intelligence (AI) systems in mission critical environments like Dept of Defence and Victorian Infectious Disease Ref Labs. Author of "Mastering 21st century Enterprise Risk Management", Greg is a strong advocate for applying Bayesian.

Fundamentals of Risk Management Microsoft Library OverDrive

This leading edge Financial Analysis, Modelling and Forecasting training course will provide you with the essential financial modelling skills to analyse and manage risk and business performance in the turbulent conditions of the 21 st century. In today's globally competitive world decision-makers face unprecedented levels of risk and.